Essay

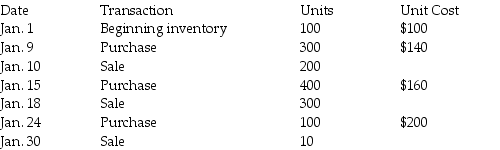

The Butters Company uses the FIFO perpetual inventory system.The company has the following data available for the month of January:

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.

Required:

Prepare the income statement for the month ending January 31,2015 using a multiple-step format.

Correct Answer:

Verified

Cost of Goods Sold:510 units

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: When following U.S. GAAP, the market value

Q38: Christian Company uses the gross method of

Q48: When costs are increasing, and inventory levels

Q66: When following U.S. GAAP, firms can use

Q86: The inventory allocation method used for companies

Q106: A fire destroyed the warehouse of Reed

Q109: What are the advantages of using of

Q110: On June 1,Johnson Company purchased $5,000 of

Q112: Hougton Company follows U.S.GAAP and has the

Q116: The retail inventory method that estimates the