Essay

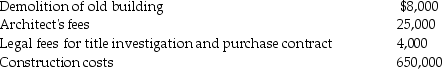

On February 1,2017,Ursa Corporation purchased a parcel of land as a factory site for $100,000.It demolished an old building on the property and began construction on a new building that was completed on October 2,2017.Costs incurred during this period are:

In addition,Ursa sold salvaged materials resulting from the demolition for $2,000.

In addition,Ursa sold salvaged materials resulting from the demolition for $2,000.

Required:

a.At what amount should Ursa record the cost of the land and the new building,respectively?

b.If management misclassified a portion of the building's cost as part of the cost of the land,what

would be the effect on the financial statements?

Correct Answer:

Verified

a.

Land:

Building:

b.

If a porti...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Land:

Building:

b.

If a porti...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Goodwill is recognized only when the purchase

Q23: Which of the following is not a

Q23: A fixed asset with a five-year estimated

Q28: Alzparker Company constructed a building at a

Q30: The period of time for which interest

Q42: U.S. GAAP requires straight-line amortization of finite-life

Q49: Which of the following statements about derecognition

Q66: U.S. GAAP requires companies to reconcile the

Q163: Which of the following is the legal

Q164: Over what period of time should goodwill