Essay

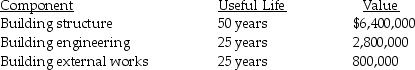

Presented below are the components related to an office building that Lorny Manufacturing Company purchased for $10,000,000 in January,2017.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.

a.Compute depreciation expense for 2017,assuming that Lorny uses component depreciation,uses the straight-line method of depreciation,and ignores scrap values.

b.Assume that the building engineering was replaced after 20 years at a cost of $2,500,000.Prepare the journal entry to record the replacement of the old component with the new component.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: What are IFRS disclosure requirements for intangible

Q40: Which of the following is not a

Q53: An improvement made to a machine increased

Q70: A copyright is an exclusive right to

Q98: In the context of constructing a plant

Q102: Under what circumstances does derecognition of an

Q137: The half-year convention is not applicable for

Q148: Which of the following is not a

Q151: For income statement purposes,when is depreciation expense

Q166: U.S. GAAP allows a firm to record