Essay

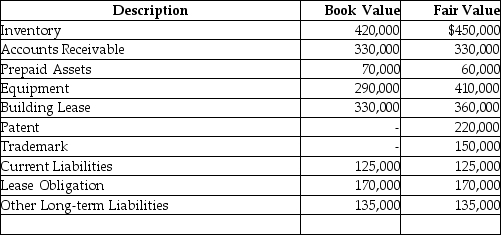

Capitol Company decided to sell one of its subsidiaries,Subsidiary ABC.BiRite Inc,is the purchaser of this subsidiary.The selling price for Subsidiary ABC is $2,000,000.BiRite performed a valuation analysis of Subsidiary's ABC assets acquired and liabilities.The following table presents book values from Subsidiary ABC financial statements and fair values determined by BiRite:

a.Prepare the journal entry made by BiRite to record the acquisition of Subsidiary ABC.

a.Prepare the journal entry made by BiRite to record the acquisition of Subsidiary ABC.

b.Describe how the journal entry would be different if the acquisition prices was $1 million.

Correct Answer:

Verified

a.

b.

If the acquisition price was ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.

If the acquisition price was ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: When a firm sells or abandons an

Q74: Firms compute the amount of avoidable interest

Q92: The purchase of a building would involve

Q94: Companies should evaluate indefinite life intangible assets

Q112: Companies commonly report the carrying value of

Q116: Which of the following is a realistic

Q119: The capitalizable value of goodwill is always

Q120: Goodwill is recorded as an intangible asset

Q122: What type of account is Accumulated Depreciation?<br>A)

Q142: Firms capitalize interest costs from the time