Multiple Choice

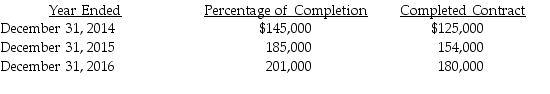

Hampton's Construction,Inc.decided to change from completed-contract method of accounting to percentage-of-completion method.Hampton will continue to us the completed-contract method for income tax purposes.The following information is available for net income.The income tax rate for all years is 35%.

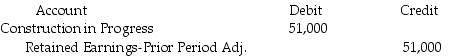

What is the journal entry to record the change in accounting principle on January 1,2016?

What is the journal entry to record the change in accounting principle on January 1,2016?

A) No journal entry need for prospective application of the change in principle.

B)

C)  Construction in Progress 72,000

Construction in Progress 72,000

D)  Retained Earnings-Prior Period Adj. 33,150

Retained Earnings-Prior Period Adj. 33,150

Correct Answer:

Verified

Correct Answer:

Verified

Q2: U.S. GAAP and IFRS accounting is the

Q40: Under U.S. GAAP, the disclosure requirements for

Q51: For a direct-finance capital lease, the lessor

Q112: Generally, the lease term is the duration

Q288: In completing the adjusting entries for 2017

Q289: The primary objective of the statement of

Q290: Emma's Clothes,Inc.has accounts receivable of $210,000.In the

Q291: Sumner leases equipment to Butler Corporation.Butler records

Q295: For a lessor to classify a lease

Q296: Changes in retained earnings always relate to