Multiple Choice

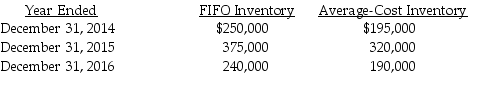

Butler Products decided to change inventory methods on January 1,2016 to more effectively report its results of operations.In the past,management has measured its ending inventories by the average-cost method and they now believe that FIFO is a better representation of its financial position and profitability.Butler's tax rate is 35% for all years.  Which one of the following journal entries correctly records the change in the accounting principle?

Which one of the following journal entries correctly records the change in the accounting principle?

A) No journal entry need for prospective application of the change in principle.

B)  Inventory 55,000

Inventory 55,000

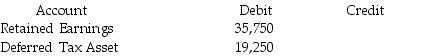

C)  Retained Earnings-Prior Period Adj. 35,750

Retained Earnings-Prior Period Adj. 35,750

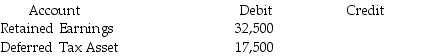

D)  Inventory 50,000

Inventory 50,000

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Retrospective changes require restatement of all periods

Q38: Determine the after-tax cumulative effect in retained

Q42: Changes in specific subsidiaries that make up

Q42: For a lessor to classify a lease

Q44: Judgments are important in determining which type

Q45: When a firm has a change in

Q47: A material error is one that if

Q52: Which of the following is a cash

Q124: If a capital lease contains a bargain

Q350: Determine the required disclosures for this series