Not Answered

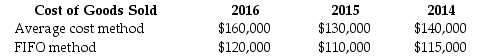

Machino,Inc.began operations on January 1,2014.During 2016,management decided to change from average-cost method to FIFO for its merchandise inventories.The change was effective at January 1,2016.Management determined that cost of goods sold for each method would be:

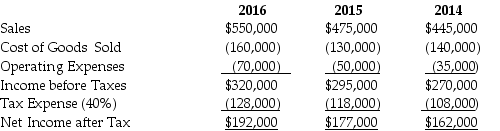

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

Required:

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Under a direct-finance capital lease, a lessor

Q41: A lessee normally computes the liability on

Q47: How do the total expenses over the

Q58: When accountants discover material errors, they must

Q68: Lessees generally depreciate leased assets over the

Q106: In determining the present value of the

Q165: The total amount of share-based compensation expense

Q172: Income statement errors in the current year

Q174: How is net income adjusted for pension

Q175: A direct financing lease is classified in