Essay

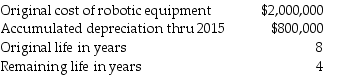

Jenkins,Inc.builds custom machines for manufacturers using robotic equipment.In 2016,the company decided to change from straight-line to double-declining-balance depreciation for its robotic equipment.It changed the life expectancy as follows:

Determine the correct amount of depreciation to expense for 2016.

Determine the correct amount of depreciation to expense for 2016.

A)$250,000

B)$300,000

C)$400,000

D)$600,000

Correct Answer:

Verified

Estimates frequently need to be adjusted...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Which of the following is not an

Q48: The lessee depreciates leasehold improvements over the

Q50: Both U.S. GAAP and IFRS require that

Q70: On the books of a lessee, a

Q70: Accounting principle changes are generally handled retrospectively.

Q154: A financial statement can provide a faithful

Q155: In determining net cash flow from operating

Q157: How does a sales-type lease differ from

Q161: Which one of the following would not

Q162: Jackson Corporation leases equipment to Andrews Company