Multiple Choice

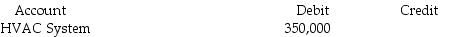

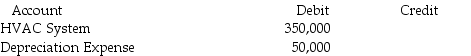

Langley Corporation replaced an HVAC system for one of its warehouses in July,2015,at a cost of $350,000.The accountant recording the purchase charged it to repairs and maintenance expense.The error was discovered early in 2017 while reconciling depreciation expense for 2016.The system should last about 7 years with no salvage value.What entry should be made before the 2016 books are closed if the company uses straight-line depreciation?

A)  Accumulated Depreciation 50,000

Accumulated Depreciation 50,000

Retained Earnings-Prior Period Adj. 300,000

B)  HVAC System 400,000

HVAC System 400,000

C)  Accumulated Depreciation 75,000

Accumulated Depreciation 75,000

Retained Earnings-Prior Period Adj. 325,000

D)  Retained Earnings-Prior Period Adj. 400,000

Retained Earnings-Prior Period Adj. 400,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: How is a guaranteed residual value accounted

Q6: List and briefly describe the various sections

Q27: Even if the firm uses the indirect

Q28: Changes in current assets relate to operating

Q33: Tarleton Company discovered ending inventory errors in

Q35: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3884/.jpg" alt=" For the Years

Q36: The first balance sheet presented under the

Q73: Bank overdrafts are considered to be a

Q88: Disclosures about noncash financing and investing activities

Q94: Which of the following is a disclosure