Multiple Choice

JAT Corp.loaned $375,000 for three years to a major supplier on July 1,2015.The note stipulated 10% interest to be paid annually each June 30.Since this was an unusual transaction,no one billed the supplier for the interest in 2016 or recorded the accrued interest at the year end (December) .On March 1,2017,after the 2016 books were closed,the CFO found the error.Which one of the following is the correct journal entry to correct the errors thru March 1,2017? (Ignore income taxes.)

A) Since it has not been billed,no entry should be made until June 30,2017.

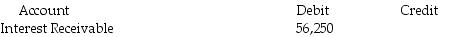

B)  Retained Earnings-Prior Period Adjustment 56,250

Retained Earnings-Prior Period Adjustment 56,250

C)  Interest Revenue 6,250

Interest Revenue 6,250

Retained Earnings-Prior Period Adjustment 56,250

D)  Interest Revenue 56,250

Interest Revenue 56,250

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Under IFRS, a capital lease is referred

Q23: When using the multiplier approach to lease

Q58: Which of the following is a disclosure

Q75: Indirect effects of changes in an accounting

Q81: Companies classify some cash flows relating to

Q329: On December 31 of the current year,Johnson

Q331: Make the journal entry to correct the

Q335: Energy,Inc began operations in 2015 using LIFO

Q336: Changes in current liabilities relate to financing

Q339: When a self-correcting error is discovered after