Essay

In 2015,Antiques,Inc.incorrectly recorded ending inventory as $970,000 instead of $790,000.The controller discovered the error in 2017 when reviewing final entries for 2016 financial statements.The 2016 ending inventory amount was correct.Tax rates for all years is 40%.Which one of the following entries is correctly written and dated?

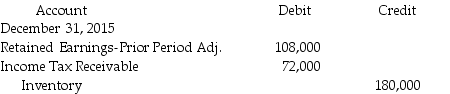

A)

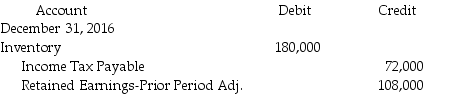

B)

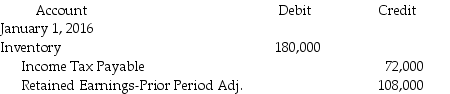

C)

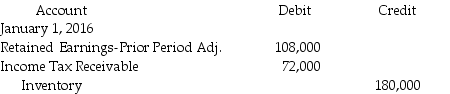

D)

Correct Answer:

Verified

This situation is a self-correcting erro...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Explain why comparability and consistency are considerations

Q72: Sumner leases a copier from Jenks Corporation

Q76: The appropriate asset value that a lessee

Q83: Under U.S. GAAP, which of the following

Q165: The total amount of share-based compensation expense

Q264: Brown Furniture Company decided to go after

Q265: Refer to Superbyte Corporation.<br>Superbyte Corporation would account

Q266: In reconciling information to complete its financial

Q269: If a lessee makes prepayments on an

Q271: Note A: Change in Method of Accounting