True/False

On January 1 of the current year,Stephens Corporation leased machinery from Montgomery Company.The machine originally cost Montgomery $250,000.The lease agreement is an operating lease,the terms of which call for five annual payments of 25,000.The first payment is due at the inception of the lease; the other three payments are due on January 1 of subsequent years.What journal entry should Stephens make on January 1 of the current year?

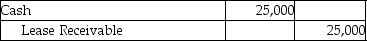

A)

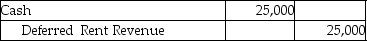

B)

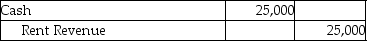

C)

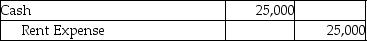

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q66: Prospective changes require changes be made to

Q72: Presenting consolidated statements instead of individual financial

Q90: When year-end occurs between payment dates, the

Q348: The indirect method of formatting the statement

Q349: Bad debt expense and share-based compensation expense

Q350: Determine the required disclosures for this series

Q351: In 2017,Quintin Corp.reported net income of $255,000.Other

Q352: When there is a unguaranteed residual value,the

Q356: Which one of the following is a

Q357: Which one of the following might be