Short Answer

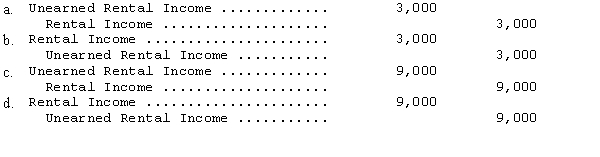

L.Lane received $12,000 from a tenant on December 1 for four months' rent of an office.This rent was for December,January,February,and March.If Lane debited Cash and credited Unearned Rental Income for $12,000 on December 1,what necessary adjustment would be made on December 31?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following is an item

Q25: The trial balance and transaction descriptions below

Q26: The following is a summary of the

Q27: Schroeder Co.had the following transactions pertaining to

Q29: The basic financial statements are listed below:<br>(1)Balance

Q36: The last step in the accounting cycle

Q39: A routine collection on a customer's account

Q53: On March 1,2012,Forest Co.borrowed cash and signed

Q67: Which of the following is true regarding

Q71: Pheasant Tail Company's total equity increased by