Short Answer

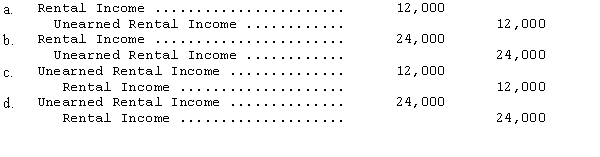

Thompson Company sublet a portion of its office space for ten years at an annual rental of $36,000,beginning on May 1.The tenant is required to pay one year's rent in advance,which Thompson recorded as a credit to Rental Income.Thompson reports on a calendar-year basis.The adjustment on December 31 of the first year should be

Correct Answer:

Verified

Correct Answer:

Verified

Q15: For a given year,beginning and ending total

Q37: Beginning and ending Accounts Receivable balances were

Q41: Which of the following regarding accrual versus

Q46: On June 30,a company paid $3,600 for

Q48: Under the cash basis of accounting,<br>A) revenues

Q78: Moon Company purchased equipment on November 1,2013,by

Q81: For a given year,beginning and ending total

Q82: The following balances have been excerpted from

Q85: Which of the following criteria must be

Q96: An adjusting entry will not take the