Essay

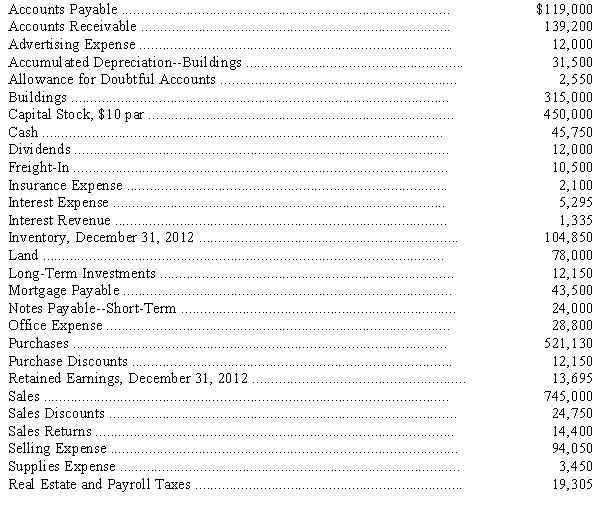

Account balances taken from the ledger of Middler Company on December 31,2013,are as follows:

Adjustments on December 31,2013,are required as follows:

(a)The inventory on hand is $135,915.

(b)The allowance for doubtful accounts is to be increased to a balance of $6,250.

(c)Buildings are depreciated at the rate of 5 percent per year.

(d)Accrued selling expenses are $6,075.

(e)There are supplies of $1,050 on hand.

(f)Prepaid insurance at December 31,2013,totals $1,290.

(g)Accrued interest on long-term investments is $360.

(h)Accrued real estate and payroll taxes are $1,170.

(i)Accrued interest on the mortgage is $240.

(j)Income tax is estimated to be 30 percent of the income before income tax (round to nearest dollar).

(1)Prepare an eight-column work sheet.

(2)Prepare adjusting and closing entries.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: On December 31 of the current year,Holmgren

Q21: A common business transaction that would not

Q32: The debit and credit analysis of a

Q33: Montague Company reported the following balances:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2120/.jpg"

Q42: Caribou Corporation shows the following balances:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2120/.jpg"

Q43: The following balances have been excerpted from

Q56: In an accrual accounting system,<br>A) all accounts

Q69: A chart of accounts is a<br>A) subsidiary

Q72: Which of the following is not among

Q73: Which of the following is not presented