Essay

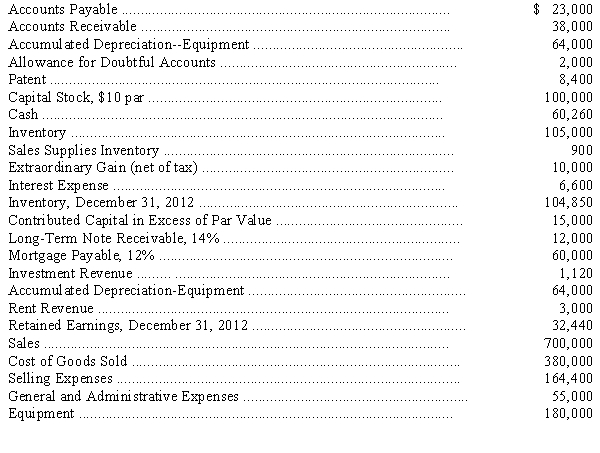

Account balances taken from the ledger of Owens Company on December 31,2013,are as follows:

Adjustments on December 31,2013,are required as follows:

(a)Estimated bad debt loss rate is 1/4 percent of credit sales.Credit sales for the year amounted to $200,000.Classify bad debt expense as a selling expense.

(b)Interest on the long-term note receivable was last collected August 31,2013.

(c)Estimated life of the equipment is 10 years,with a residual value of $20,000.Allocate 10 percent of depreciation expense to general and administrative expense and the remainder to selling expenses.Use straight-line depreciation.

(d)Estimated economic life of the patent is 14 years (from January 1,2013)with no residual value.Straight-line amortization is used.Depreciation expense is classified as selling expense.

(e)Interest on the mortgage payable was last paid on November 30,2013.

(f)On June 1,2013,the company rented some office space to a tenant for one year and collected $3,000 rent in advance for the year; the entire amount was credited to rent revenue on this date.

(g)On December 31,2013,the company received a statement for calendar year 2013 property taxes amounting to $1,300.The payment is due February 15,2014.Assume that the payment will be made on February 15,2014,and classify expense as selling expense.

(h)Sales supplies on hand at December 31,2013,amounted to $300; classify as selling expense.

(i)Assume an average income tax rate of 40 percent corporate tax rate on all items including the extraordinary gain..

(1)Prepare an eight-column work sheet.

(2)Prepare adjusting and closing entries.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: The use of computers in processing accounting

Q38: On August 1,a company received cash of

Q46: On June 30,a company paid $3,600 for

Q47: Failure to record depreciation expense at the

Q54: How would proceeds received in advance from

Q55: At the end of the current fiscal

Q82: The following balances have been excerpted from

Q88: Scott Co.reported an allowance for doubtful accounts

Q89: Iowa Cattle Company uses a periodic inventory

Q97: On September 1,2012,Star Corp.issued a note payable