Essay

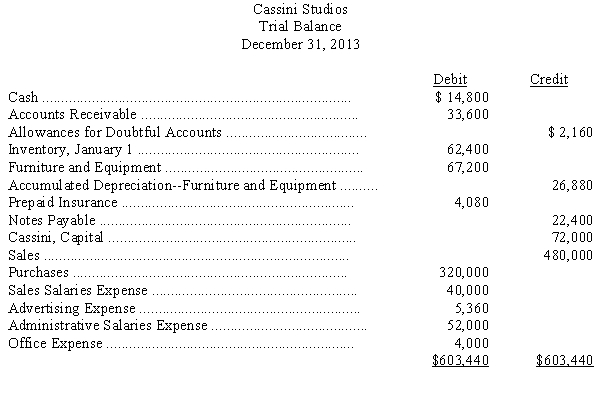

Presented below is the December 31 trial balance of Cassini Studios.

(1)Prepare adjusting journal entries for the following items:

(a)Adjust the Allowance for Doubtful Accounts to 8 percent of the accounts receivable.

(b)Furniture and equipment is depreciated at 20 percent per year.

(c)Insurance expired during the year,$2,040.

(d)Interest accrued on notes payable,$2,688.

(e)Sales salaries earned but not paid,$1,920.

(f)Advertising paid in advance,$560.

(g)Office supplies on hand,$1,200,charged to Office Expense when purchased.

(2)Prepare closing entries for Cassini after the above adjusting entries have been made.Additional information shows the inventory on December 31 was $64,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: On December 31 of the current year,Holmgren

Q21: A common business transaction that would not

Q27: Schroeder Co.had the following transactions pertaining to

Q29: The basic financial statements are listed below:<br>(1)Balance

Q32: The debit and credit analysis of a

Q33: Montague Company reported the following balances:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2120/.jpg"

Q43: Which of the following accounts most likely

Q53: On March 1,2012,Forest Co.borrowed cash and signed

Q66: The work sheet of PSI Company shows

Q69: A chart of accounts is a<br>A) subsidiary