Essay

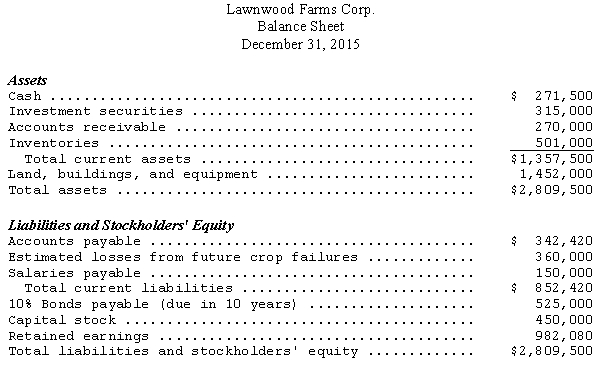

The following balance sheet was prepared by the accountant for Lawnwood Farms Corp.:

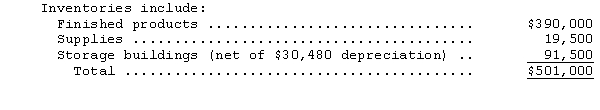

Additional information:

(a)Cash is held in a checking account and a savings account with balances of $69,450 and $202,050,respectively.The cash in the savings account will be used to support operations in the event of a crop failure.

(b)A loan to the president for $180,000 that is to be repaid in quarterly installments of $15,000 is included in "Accounts receivable." Other accounts receivable are considered to be 95 percent collectible.

(c)

(d)"Land,buildings,and equipment" includes 5 tractors that were purchased near the end of the year for $360,000 (shown net of a $300,000,5-year loan used to buy the tractors).The balance of the account consists of land that was purchased for $1,200,000 and buildings that were purchased for $255,000 (shown net of depreciation of $63,000).

(e)Included in "Accounts payable" are $105,000 of advances from customers for delivery of goods in August of the next year.

(f)The company has 90,000 shares of $5 par common stock issued and outstanding.The common stock was originally sold for $7 per share,and the premium was included in "Retained earnings."

(g)After reading a U.S.Meteorological Service report,the president believes that next year will be a bad crop year due to freak hailstorms and estimates the company will lose about $360,000.An appropriation of Retained Earnings has been made for this amount.

Using the balance sheet and the additional information,prepare a properly classified and corrected balance sheet.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Laramie Corporation was organized on January 3,2015.Laramie

Q17: Which of the following statements regarding assets

Q19: Accrued revenues would normally appear on the

Q46: Investment securities held for the purpose of

Q63: Hondo Co.has total debt of $252,000 and

Q65: You have just joined the public accounting

Q66: Sonar Company prepared a draft of its

Q67: The December 31,2014,balance sheet of Giorgio Inc.,reported

Q68: Audition and Co.,CPAs,has just been retained by

Q71: Which item describes whether the following accounts