Essay

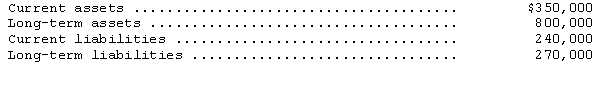

The following totals are taken from the December 31,2015,balance sheet of Mentor Company:

Additional information:

(a)Cash of $38,000 has been placed in a fund for the retirement of long-term debt.The cash and long-term debt have been offset and are not reflected in the financial statements.

(b)Long-term assets include $50,000 in treasury stock.

(c)Cash of $14,000 has been set aside to pay taxes due.The cash and taxes payable have been offset and do not appear in the financial statements.

(d)Advances on salespersons' commissions in the amount of $21,000 have been made.Also,sales commissions payable total $24,000.The net liability of $3,000 is included in Current Liabilities.

After making any necessary changes,what are the totals for Mentor's current assets and current liabilities?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The term "deficit" refers to<br>A) an excess

Q5: Which of the following statements regarding intangible

Q6: Laramie Corporation was organized on January 3,2015.Laramie

Q7: Which of the following characteristics may result

Q14: Pending litigation would generally be considered a(n)<br>A)

Q27: The balance sheet category receivables represents claims

Q50: Knowledgeable users of financial statements recognize that

Q56: The following changes in American Corporation's account

Q58: Unearned rent would normally appear on the

Q59: Information from Osborne Company's balance sheet is