Essay

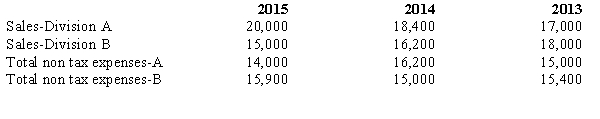

Jonathan L.Supreme Company has two divisions,A and B.The operations and cash flows of these two divisions are clearly distinguishable.On July 1,2015,the company decided to dispose of the assets and liabilities of Division B.It is probable that the disposal will be completed early next year.The revenues and expenses of Jonathan L.Supreme Company for 2015 and for the preceding two years are as follows:

During the latter part of 2015,Jonathan L.Supreme disposed of a portion of Division B and recognized a pretax loss of $8,000 on the disposal.The income tax rate for Jonathan L.Supreme Company is 40%.

Prepare the comparative income statements for Jonathan L.Supreme Company for the years 2013,2014,and 2015.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Which of the following most likely would

Q19: The financial statements of Bollinger Corporation for

Q22: The changes in account balances of the

Q25: The following data are available for Synopsis

Q28: Harris Company reported the following results from

Q29: Ladrillo Enterprises,Inc.,has two operating divisions,one manufactures farm

Q38: Changes in accounting principles generally are reported

Q61: Which of the following is true regarding

Q67: Which of the following would NOT be

Q72: Seaworthy Company's gross sales in 2014 were