Essay

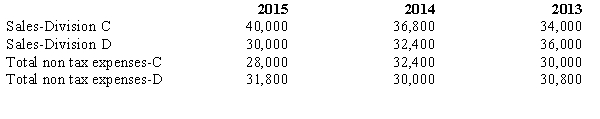

Amityville Company has two divisions,C and D.The operations and cash flows of these two divisions are clearly distinguishable.On July 1,2015,the company decided to dispose of the assets and liabilities of Division D.It is probable that the disposal will be completed early next year.The revenues and expenses of Amityville Company for 2015 and for the preceding two years are as follows:

During the latter part of 2015,Amityville disposed of a portion of Division D and recognized a pretax loss of $10,000 on the disposal.The income tax rate for Amityville Company is 40%.

Prepare the comparative income statements for Amityville Company for the years 2013,2014,and 2015.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: All of the following would appear on

Q5: Soluble Water Products had sales during 2014

Q14: A company that changes from the declining-balance

Q18: Which of the following is NOT an

Q31: Funnies-R-Us,Inc.committed to sell its comic book division

Q33: A significant part of the compensation received

Q37: Barrister Corporation separates operating expenses in two

Q38: Apollo Company incurred the following infrequent losses

Q40: Sovereign Enterprises,Inc.,has two operating divisions,one manufactures machinery

Q46: On June 30,2014,Sonata Company's operating facilities in