Multiple Choice

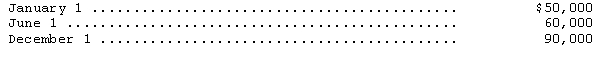

A company made the following cash expenditures on a self-constructed building begun January 1 of the current year:

The building is still under construction at year-end.What is the amount of the average accumulated expenditures for the purpose of capitalizing interest?

A) $87,500

B) $92,500

C) $100,000

D) $200,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Diamond,Inc.purchased a machine under a deferred payment

Q28: On-Call Service Corporation bought a building lot

Q28: On February 1,2013,Forwards Corporation purchased a parcel

Q29: You are the auditor of Donaldson Corporation,a

Q33: On July 31,2014,Mason Company purchased for $4,000,000

Q34: Solara Company entered into a contract with

Q52: A company is constructing an asset for

Q54: According to SFAS No.34,"Capitalization of Interest Cost,"

Q55: Which of the following is true regarding

Q79: According to the most current FASB standards,intangible