Multiple Choice

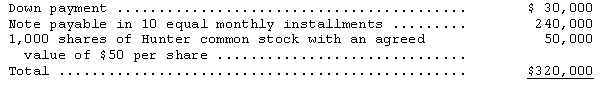

In January,Fanning Corporation entered into a contract to acquire a new machine for its factory.The machine,which had a cash price of $400,000,was paid for as follows:

Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?

A) $38,100

B) $39,100

C) $40,000

D) $41,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: When an exchange of similar assets involves

Q7: Raptor Company owns a tract of land

Q24: Which of the following is NOT required

Q34: Harrison Company is located in Taiwan and

Q35: Five years ago,Monroe,Inc. ,purchased a patent for

Q38: In accordance with generally accepted accounting principles,which

Q51: On July 1,Toucan Corporation,a calendar-year company,received a

Q53: Stanley Company purchased a machine that was

Q63: A company using the group depreciation method

Q74: Pepitone Inc.exchanged a machine costing $400,000 with