Multiple Choice

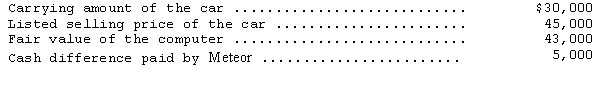

Meteor Motor Sales exchanged a car from its inventory for a computer to be used as a noncurrent operating asset.The following information relates to this exchange that took place on July 31,2014:

The exchange has commercial substance.

On July 31,2014,how much profit should Meteor recognize on this exchange?

A) $0

B) $8,000

C) $10,000

D) $13,000

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The Fanfare Company applied for and received

Q36: On January 1,2012,Costas Co.purchased a new machine

Q39: Backhoe Construction Company recently exchanged an old

Q43: Nielsen Cargo Company recently exchanged an old

Q45: Ibarra Carpet traded cleaning equipment with a

Q63: Mueller Company purchased equipment 8 years ago

Q69: A recently issued FASB standard requires that

Q70: A depreciable asset has an estimated 15

Q73: Which of the following depreciation methods applies

Q75: During 2009,Cabot Machine Company spent $352,000 on