Short Answer

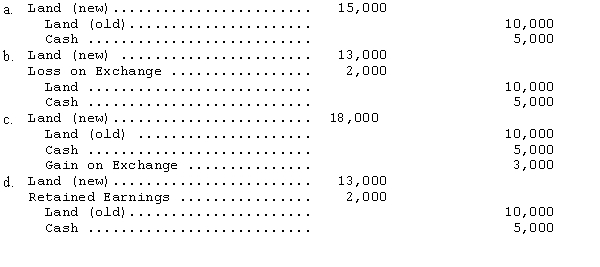

A company owns a piece of land that originally cost $10,000 and has a fair market value of $8,000.It is exchanged along with $5,000 cash for another piece of land having a fair value of $13,000.The exchange had commercial substance.The proper journal entry to record this transaction is

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following depreciation methods most

Q4: When the estimate of an asset's useful

Q26: On January 1,2013,Pastel Colors Corporation purchased drilling

Q39: Backhoe Construction Company recently exchanged an old

Q43: Nielsen Cargo Company recently exchanged an old

Q45: Ibarra Carpet traded cleaning equipment with a

Q56: Cavallo Company acquired a tract of land

Q59: The Corey Company exchanged equipment costing $190,000

Q63: Mueller Company purchased equipment 8 years ago

Q75: During 2009,Cabot Machine Company spent $352,000 on