Essay

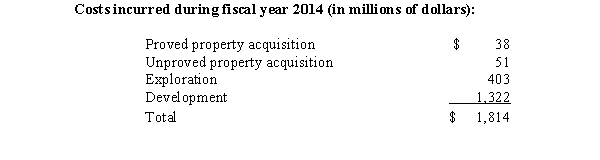

The 2014 annual report of Fracking,Inc.,provides the following disclosures regarding its oil and gas operations:

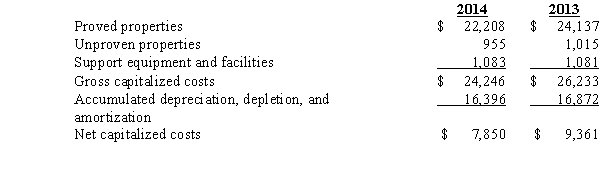

During 2014,the company reported exploration expenses totaling $306 million,and depreciation,depletion,and amortization totaling $1,198 million.The amount of capitalized costs for the fiscal years ending December 31,2014,and 2013,were:

Capitalized costs for fiscal years ending December 31,2014,and 2013 (in millions dollars):

Fracking uses the successful-efforts method to account for exploration costs.

Required:

1.What amount of the exploration cost incurred by Fracking in 2014 were capitalized?

2.If Fracking were using the full-cost method of accounting for exploration cost,what amount of exploration cost would be capitalized in 2014.State any assumptions made in order to answer this question.

3.Use the information above to determine the amount of capitalized costs removed (retired or otherwise disposed of)from the capitalized cost account,and the amount of accumulated depreciation,depletion,and amortization related to this item.

Correct Answer:

Verified

1.Fracking uses the successful efforts m...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: The sale of a depreciable asset resulting

Q12: The Bromley Company purchased a tooling machine

Q26: On January 1,2013,Pastel Colors Corporation purchased drilling

Q46: Roadworthy Company acquired Highway Company on January

Q47: Legal fees incurred in successfully defending a

Q49: Masdirt Mining Company has a copper mine

Q56: Cavallo Company acquired a tract of land

Q57: Zenith Corporation bought a machine on January

Q59: A method that ignores salvage value in

Q67: Hyde Company traded in an old machine