Multiple Choice

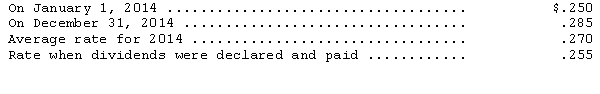

Hosgood Distributing Inc.converts its foreign subsidiary financial statements using the translation process.Their German subsidiary reported the following for 2014: revenues and expenses of 9,050,000 and 6,400,000 marks,respectively,earned or incurred evenly throughout the year,dividends of 2,000,000 marks were paid during the year.The following exchange rates are available:

Translated net income for 2014 is

A) $755,250.

B) $715,500.

C) $662,500.

D) $675,750.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Under international accounting standards,the derecognition of receivables

Q15: Under international accounting standards,cash paid for income

Q17: Pilsner Company.converts its foreign subsidiary financial statements

Q19: Windsor Enterprises,a subsidiary of Kennedy Company based

Q21: Which of the following statements is correct?<br>A)

Q23: Transit Importing Company.converts its foreign subsidiary financial

Q26: Ginza Enterprises,a subsidiary of Universal Enterprises based

Q30: Which of the following is NOT a

Q51: Under international accounting standards,revenue is recognized<br>A) only

Q53: Which of the following statements is correct?<br>A)