Multiple Choice

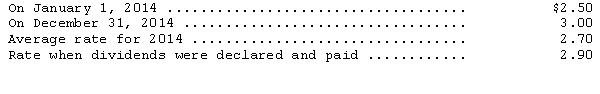

Finnish Company converts its foreign subsidiary financial statements using the translation process.The company's subsidiary in Denmark reported the following for 2014: revenues and expenses of 95,000 and 63,000 kroner,respectively,earned or incurred evenly throughout the year,dividends of 43,000 kroner were paid during the year.The following exchange rates are available:

Translated net income for 2014 is

A) $86,400.

B) $96,000.

C) $(29,700) .

D) $(28,500) .

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A translation adjustment resulting from the translation

Q9: The primary purpose of the Security and

Q16: Under international accounting standards,the pension-related asset or

Q32: Which of the following statements regarding international

Q39: Under international accounting standards,cash received from dividends

Q53: Under international accounting standards,remote contingent liabilities are<br>A)not

Q54: Which of the following is the primary

Q57: Which of the following is true regarding

Q61: On July 15,2014,American Manufacturing Inc.,a Los Angeles

Q62: McGovern Corporation,a U.S.company,owns a 100% interest in