Multiple Choice

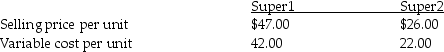

Super Corporation manufactures two products,Super1 and Super2.The following annual information was gathered:  Total annual fixed costs are $25,000.Assume Super Corporation manufactures and sells three units of Super1 for every two units of Super2.The company produced and sold 1,500 units of Super1.What is the operating income (loss) for this year?

Total annual fixed costs are $25,000.Assume Super Corporation manufactures and sells three units of Super1 for every two units of Super2.The company produced and sold 1,500 units of Super1.What is the operating income (loss) for this year?

A) $(13,500)

B) $(25,000)

C) $22,500

D) $34,500

Correct Answer:

Verified

Correct Answer:

Verified

Q105: The split-off point is the juncture in

Q117: Superglue Corporation manufactures two products,Product1 and Product2.The

Q118: Bird Company manufactures a part for its

Q121: Tucson Corporation has a joint process that

Q123: Beth is considering leaving her current position

Q124: Somala Corporation has a joint process that

Q125: To make outsourcing services a good option,the

Q126: Opportunity cost _.<br>A)is the contribution margin of

Q127: Swensen Company is considering the replacement of

Q138: When making a decision to replace some