Multiple Choice

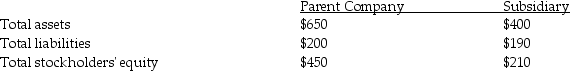

On January 1,2012,a parent company acquired all of the stock of a subsidiary.The following data is available:  The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $250 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?

The acquisition by the parent company represents a 100 percent interest in the subsidiary.On January 1,2012,the fair value of the subsidiary's assets and liabilities are equal to their book value.The parent company paid $250 for the 100 percent interest in the subsidiary.What amount of goodwill is implied in the purchase?

A) $0

B) $10

C) $40

D) $200

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Goodwill can only be recognized when one

Q62: Marketable securities that the investor company does

Q64: The following information is available for the

Q66: The following information is available for the

Q69: On January 1,2015,Julia Company acquired 80 percent

Q71: Goelzer Company has the following income statement

Q72: An investor in available-for-sale securities has the

Q81: If the fair value of a subsidiary's

Q90: When a company acquires all of the

Q93: Goodwill is amortized on the consolidated financial