Essay

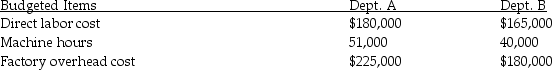

Splitsville Company has two departments.Factory overhead costs are applied based on direct labor cost in Department A and machine hours in Department B.The following information is available:

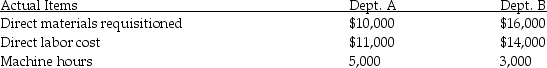

Actual data for Job #10 are as follows:

Actual data for Job #10 are as follows:

Required:

Required:

A)Compute the budgeted factory overhead rate for Department A.

B)Compute the budgeted factory overhead rate for Department B.

C)What is the total overhead cost for Job #10?

D)If Job #10 consists of 50 units of product,what is the unit cost of this job?

Correct Answer:

Verified

A)$225,000/$180,000 = 125% of direct lab...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: In job-order costing,all the costs for a

Q33: The manufacturing costs of the Assembly Department

Q34: Bruce Company uses job-order costing.The company has

Q35: Managers need to know product costs to

Q36: Highlighter Company manufactures phones in a two-department

Q37: Actual factory overhead costs are Depreciation expense--equipment

Q39: Michelangelo's Pizza Company makes pizzas.The company uses

Q40: In job-order costing,a debit to Direct-Materials Inventory

Q41: Chemical and oil companies normally use process

Q43: In job-order costing,the journal entry to record