Essay

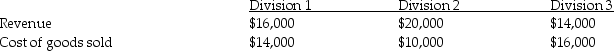

Bears Company has three divisions and allocates central corporate costs of $17,500 to each division based on two different cost drivers that include revenue and cost of goods sold.

Required:

Required:

A)Allocate the central corporate costs to each division using revenue as the cost driver.

B)Allocate the central corporate costs to each division using cost of goods sold as the cost driver.

Correct Answer:

Verified

A)Division 1: $17,500 x 16/50 = $5,600 D...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: When allocating fixed costs from service departments

Q37: The relative-sales-value method of allocating joint costs

Q58: Wolf Company processes copper ore into two

Q59: The preferred cost allocation base for central

Q60: Aguia Company has two service departments,Maintenance and

Q61: Hawn Company manufactures two models of pens,a

Q63: Haha Company manufactures two models of pens,a

Q65: Bunny Company manufactures three products from a

Q66: Typical cost drivers in a traditional approach

Q67: Joint costs are allocated to main products