Essay

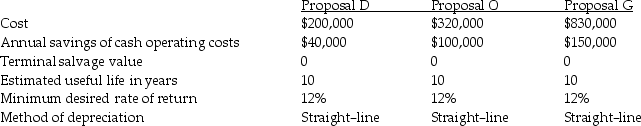

Dolly Company is contemplating three different equipment investments.The relevant data follows:

The present value factor of an ordinary annuity for 10 periods at 12% is 5.6502.

The present value factor of an ordinary annuity for 10 periods at 12% is 5.6502.

The present value factor of one for 10 periods at 12% is 0.322.

Required:

A)Compute the net present value of each investment.Ignore income taxes.

B)If only one investment can be acquired,which investment should be chosen?

Correct Answer:

Verified

A) Proposal D: NPV = ($40,000 x 5.6502)-...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: An asset of $270,000 is expected to

Q2: The lower the minimum desired rate of

Q4: A disadvantage of the accounting rate of

Q5: Tax avoidance is demonstrated by recording fictitious

Q7: An asset with a book value of

Q8: Accelerated depreciation methods _.<br>A)reduce an assets' estimated

Q9: Forever Company has a tax rate of

Q10: Ajax Company pays 15% on the first

Q41: In the NPV method,errors in forecasting terminal

Q76: The present value of tax savings from