Essay

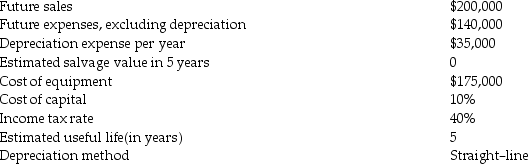

Slowly Company has obtained the following information about a proposed project:

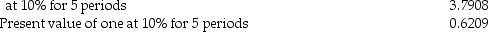

Present value of ordinary annuity

Present value of ordinary annuity

Required:

Required:

A)What is the net after-tax income per year?

B)What is the annual after-tax cash flow from depreciation expense?

C)What is the NPV of the project?

Correct Answer:

Verified

A) ($200,000 - $140,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: A manager is considering the following investment:

Q25: The minimum desired rate of return on

Q26: Samsonite Company will purchase a van for

Q27: Woods Company is considering the purchase of

Q29: The phases of capital budgeting do NOT

Q33: An asset with a book value of

Q34: A company is considering the acquisition of

Q35: A company is evaluating two different pieces

Q45: _ is a capital budgeting model that

Q78: Discounted-cash-flow models are not based on the