Multiple Choice

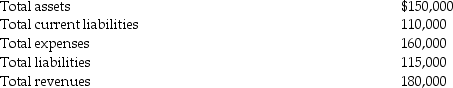

The following information pertains to Moore Company:  Invested capital is defined as total assets.The weighted average cost of capital is 10%.A project earning a ROI of 12% should be ________.

Invested capital is defined as total assets.The weighted average cost of capital is 10%.A project earning a ROI of 12% should be ________.

A) accepted

B) rejected

C) compared to the company's ROI

D) compared to the company's residual income

Correct Answer:

Verified

Correct Answer:

Verified

Q86: In return on investment calculations,we should measure

Q89: Performance-based rewards can be monetary or nonmonetary.

Q110: The transfer price is revenue to the

Q118: Multinational companies use transfer pricing to minimize

Q119: Organizations should choose performance metrics that improve

Q120: Managers evaluated using net book value will

Q126: Companies using EVA consider research and development

Q128: Which of the following statements about management

Q129: Historical cost is widely used for asset

Q140: Residual income is defined as _.<br>A) sales