Multiple Choice

What are the correct monthly rates for calculating failure to file and failure to pay penalties?

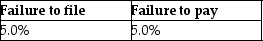

A)

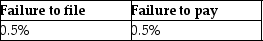

B)

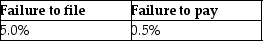

C)

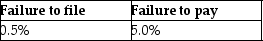

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Limited liability company members (owners)are responsible for

Q9: The term "tax law" includes<br>A)Internal Revenue Code.<br>B)Treasury

Q13: The Sixteenth Amendment permits the passage of

Q28: The federal income tax is the dominant

Q36: A taxpayer's average tax rate is the

Q44: While federal and state income taxes,as well

Q52: Describe the steps in the legislative process

Q56: Individuals are the principal taxpaying entities in

Q70: Property transferred to the decedent's spouse is

Q82: Helen,who is single,is considering purchasing a residence