Essay

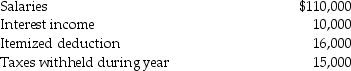

Brad and Angie had the following income and deductions during 2013:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

$110,000 + 10,000 - $16,000 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A tax bill introduced in the House

Q23: The IRS must pay interest on<br>A)all tax

Q31: The tax law encompasses administrative and judicial

Q32: Sarah contributes $25,000 to a church.Sarah's marginal

Q40: If a taxpayer's total tax liability is

Q42: All of the following statements are true

Q54: Which of the following is not an

Q61: The marginal tax rate is useful in

Q89: Eric dies in the current year and

Q96: In 2013,an estate is not taxable unless