Essay

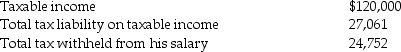

Frederick failed to file his 2012 tax return on a timely basis.In fact,he filed his 2012 income tax return on October 31,2013,(the due date was April 15,2013)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2012 return:

Frederick sent a check for $2,309 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2012.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $2,309 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2012.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Correct Answer:

Verified

Since Frederick's return is filed late a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: S Corporations result in a single level

Q21: For gift tax purposes,a $14,000 annual exclusion

Q37: The unified transfer tax system<br>A)imposes a single

Q41: Property is generally included on an estate

Q46: In an S corporation,shareholders<br>A)are taxed on their

Q47: Martha is self-employed in 2013.Her business profits

Q52: Describe the steps in the legislative process

Q54: Jeffery died in 2013 leaving a $6,000,000

Q72: All of the following are executive (administrative)sources

Q94: Larry and Ally are married and file