Multiple Choice

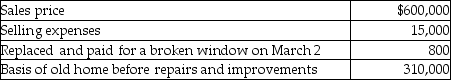

Pierce,a single person age 60,sold his home this year.He had lived in the house for 10 years.He signed a contract on March 4 to sell his home.  Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

A) $-0-

B) $25,000

C) $40,000

D) $275,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: Real property exchanged for personal property qualifies

Q50: Indicate with a "yes" or a "no"

Q63: Under what circumstances can a taxpayer obtain

Q65: An involuntary conversion is due to the

Q73: Ron's building,which was used in his business,was

Q81: Mitchell and Debbie,both 55 years old and

Q82: In the case of married taxpayers,an individual

Q327: Ike and Tina married and moved into

Q924: The basis of non- like- kind property

Q1201: In 1997, Paige paid $200,000 to purchase