Multiple Choice

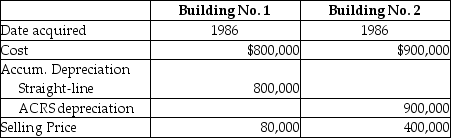

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for the first building and the accelerated method (ACRS) was used for the second building.Information about those buildings is presented below.  How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

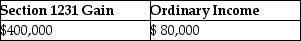

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

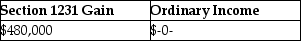

A)

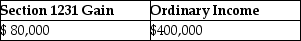

B)

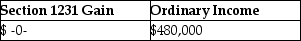

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Connors Corporation sold a warehouse during the

Q20: The additional recapture under Sec.291 is 25%

Q21: If Section 1231 applies to the sale

Q22: Emily,whose tax rate is 28%,owns an office

Q30: Millicent makes a gift of an organ

Q31: Cassie owns equipment ($45,000 basis and $30,000

Q38: Indicate whether each of the following assets

Q44: Section 1250 could convert a portion of

Q83: Dinah owned land with a FMV of

Q92: Gains and losses resulting from condemnations of