Multiple Choice

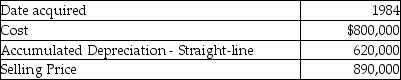

A corporation sold a warehouse during the current year.The straight-line depreciation method was used.Information about the building is presented below:  How much gain should the corporation report as section 1231 gain?

How much gain should the corporation report as section 1231 gain?

A) $124,000

B) $620,000

C) $586,000

D) $710,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: When gain is recognized on an involuntary

Q26: A building used in a business for

Q32: Any gain or loss resulting from the

Q37: During the current year,Hugo sells equipment for

Q50: Pam owns a building used in her

Q54: Jed sells an office building during the

Q55: In addition to the normal recapture rules

Q81: For a business,Sec.1231 property does not include<br>A)timber,coal,or

Q93: Sec.1245 applies to gains on the sale

Q1297: Sarah owned land with a FMV of