Essay

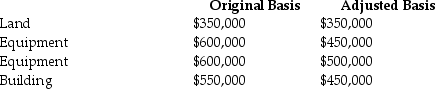

Describe the tax treatment for a noncorporate taxpayer in the 39.6% marginal tax bracket who sells each of the first two assets for $500,000 and each of the second two assets for $750,000.Each asset was purchased in 2009 and is used in a trade or business.There are no other gains and losses and no nonrecaptured Section 1231 losses.

Correct Answer:

Verified

• Land: $150,000 Section 1231 gain taxed...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: All of the following are considered related

Q9: Eric purchased a building in 2003 that

Q20: The additional recapture under Sec.291 is 25%

Q31: Cassie owns equipment ($45,000 basis and $30,000

Q38: Indicate whether each of the following assets

Q45: Gain recognized on the sale or exchange

Q61: WAM Corporation sold a warehouse during the

Q83: Dinah owned land with a FMV of

Q102: Pete sells equipment for $15,000 to Marcel,his

Q108: Depreciable property used in a trade or