Essay

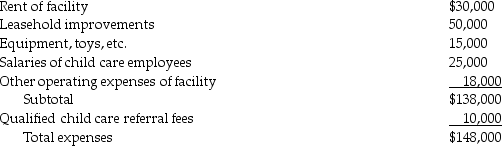

Hawaii,Inc.,began a child care facility for its employees during the year.The corporation incurred the following expenses:

What is the amount of Hawaii's credit for employer-provided child care?

What is the amount of Hawaii's credit for employer-provided child care?

Correct Answer:

Verified

The credit is ($138,000 × .25)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: The child and dependent care credit provides

Q32: Sonya started a self-employed consulting business in

Q39: The present AMT applies to individuals,corporations,estates,and trusts.

Q45: Rex has the following AMT adjustments: -Depreciation

Q81: All of the following are allowable deductions

Q98: In computing the alternative minimum taxable income,no

Q100: During the year,Jim incurs $50,000 of rehabilitation

Q110: Research expenses eligible for the research credit

Q112: Nonrefundable tax credits<br>A)only offset a taxpayer's tax

Q118: When a husband and wife file a