Essay

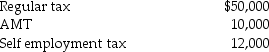

Beth and Jay project the following taxes for the current year:

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

a.AGI of $140,000 and total taxes of $36,000.

b.AGI of $155,000 and total taxes of $50,000.

Correct Answer:

Verified

a.The taxpayers should pay i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a.The taxpayers should pay i...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Mark and Stacy are married,file a joint

Q30: Which of the following is not a

Q50: An individual with AGI equal to or

Q75: To claim the Lifetime Learning Credit,a student

Q95: A corporation has $100,000 of U.S.source taxable

Q97: John has $55,000 net earnings from a

Q99: Casualty and theft losses in excess of

Q103: Self-employment taxes include components for<br>A)Medicare hospital insurance

Q105: Ivan has generated the following taxes and

Q108: Individuals without children are eligible for the