Multiple Choice

Joey and Bob each have 50% interest in a Partnership.Both Joey and the partnership file returns on a calendar year basis.Partnership Q had a $12,000 loss in 2013.Joey's adjusted basis in his partnership interest on January 1,2013 was $5,000.In 2014,the partnership had a profit of $10,000.Assuming there were no other adjustments to Joey's basis in the partnership,what amount of partnership income (loss) should Joey show on his 2013 and 2014 individual income tax returns?

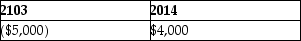

A)

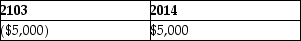

B)

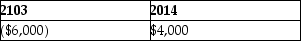

C)

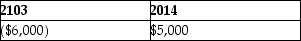

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Scott provides accounting services worth $40,000 to

Q29: An S corporation distributes land with a

Q32: Hunter contributes property having a $75,000 FMV

Q36: On July 1,Joseph,a 10% owner,sells his interest

Q46: Chen contributes a building worth $160,000 (adjusted

Q74: An LLC that elects to be taxed

Q80: A business distributes land to one of

Q85: Stephanie owns a 25% interest in a

Q120: Which of the following characteristics can disqualify

Q140: The basis of a partner's interest in