Multiple Choice

What are the correct monthly rates for calculating failure to file and failure to pay penalties?

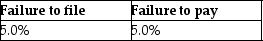

A)

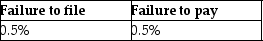

B)

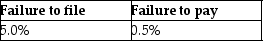

C)

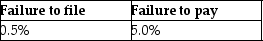

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: What is an important aspect of a

Q18: Arthur pays tax of $5,000 on taxable

Q21: All of the following are classified as

Q30: Thomas dies in the current year and

Q37: The unified transfer tax system<br>A)imposes a single

Q41: Property is generally included on an estate

Q71: Jillian,a single individual,earns $230,000 in 2014 through

Q87: Kate files her tax return 36 days

Q95: Which of the following statements is incorrect?<br>A)Property

Q103: An individual will be subject to gift