Essay

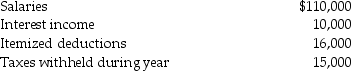

Brad and Angie had the following income and deductions during 2014:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

$110,000 + 10,000 - $16,000 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A tax bill introduced in the House

Q13: The Sixteenth Amendment permits the passage of

Q15: Jeffery died in 2014 leaving a $16,000,000

Q21: For gift tax purposes,a $14,000 annual exclusion

Q27: Flow-through entities do not have to file

Q46: In an S corporation,shareholders<br>A)are taxed on their

Q50: When returns are processed,they are scored to

Q66: Which is not a component of tax

Q79: Which of the following individuals is most

Q421: Explain how returns are selected for audit.