Essay

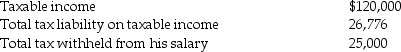

Frederick failed to file his 2014 tax return on a timely basis.In fact,he filed his 2014 income tax return on October 31,2015,(the due date was April 15,2015)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2014 return:

Frederick sent a check for $1,776 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2014.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,776 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2014.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Correct Answer:

Verified

Since Frederick's return is filed late a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: A progressive tax rate structure is one

Q23: The IRS must pay interest on<br>A)all tax

Q31: The tax law encompasses administrative and judicial

Q34: Horizontal equity means that<br>A)taxpayers with the same

Q48: A proportional tax rate is one where

Q82: Mia is self-employed as a consultant.During 2013,Mia

Q83: Denzel earns $130,000 in 2014 through his

Q88: Rocky and Charlie form RC Partnership as

Q89: Which of the following is not one

Q91: Which of the following is not a