Multiple Choice

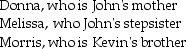

John supports Kevin,his cousin,who lived with him throughout 2014.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $3,950. How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $3,950. How many personal and dependency exemptions may John claim?

A) 2

B) 3

C) 4

D) 5

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Rob is a taxpayer in the top

Q50: David's father is retired and receives $14,000

Q71: Tony supports the following individuals during the

Q74: You may choose married filing jointly as

Q77: Generally,itemized deductions are personal expenses specifically allowed

Q115: All of the following items are deductions

Q125: Paul and Hannah,who are married and file

Q126: Maxine,who is 76 years old and single,is

Q129: Sean and Martha are both over age

Q929: Oscar and Diane separated in June of