Multiple Choice

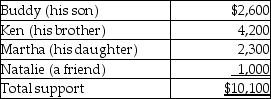

Blaine Greer lives alone.His support comes from the following sources:  Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

A) Ken or Martha

B) Buddy,Ken,or Martha

C) Ken,Martha,or Natalie

D) None of them

Correct Answer:

Verified

Correct Answer:

Verified

Q15: If a 13-year-old has earned income of

Q22: Married couples will normally file jointly.Identify a

Q24: Paul and Sally file a joint return

Q31: Eliza Smith's father,Victor,lives with Eliza who is

Q55: The filing status in which the rates

Q107: Shane and Alyssa (a married couple)have AGI

Q111: Taxable income for an individual is defined

Q111: For each of the following independent cases,indicate

Q113: Brett,a single taxpayer with no dependents,earns salary

Q146: The person claiming a dependency exemption under